Advisory on Bank Account Validation Under GST

📄 GSTN is pleased to inform you that the functionality for bank account validation is now integra…

Read moreBudget 2023 Highlights

HIGHLIGHTS OF THE UNION BUDGET 2023-24 The Union Minister of Finance and Corporate Affairs Smt. N…

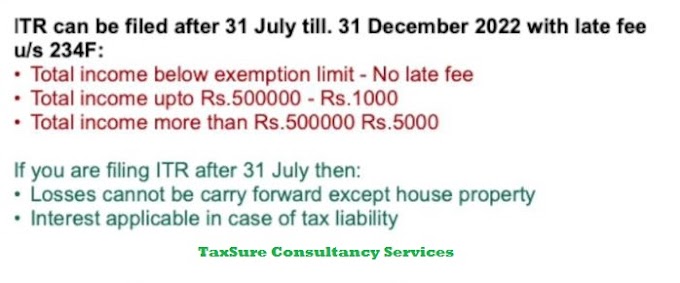

Read moreNew ITR filing date after 31July without any Late Fee & New Change in ITR rules from 1 August 2022

Income Tax Return Can be Filled after 31st July Till 31st December With Late Fees u/s 234F which …

Read moreICAI CA Result May 2022 – Foundation, Intermediate & Final @icaiexam.icai.org

The Institute of Chartered Accountants of India has conducted the CA Foundation, Intermediate &am…

Read moreIncome Tax Slab Rates for A.Y. 2023-24 | F.Y. 2022-23

Income Tax Slab Rates for A.Y. 2023-24 | F.Y. 2022-23 Income Tax Rates applicable for Individuals, …

Read moreRefund of GST TCS for Online Sellers of E-Commerce Operators

Refund of GST TCS for Online Sellers of E-Commerce Operators (for e.g. Flipkart, Amazon, Snapdeal, …

Read moreBudget 2022 Highlights

Direct Taxes – Income Tax A new provision is introduced to allow taxpayers to update the past ret…

Read moreTDS on cash withdrawal in excess of Rs 1 crore [Section 194N]

To discourage cash payments, the Union Budget 2019 has introduced Section 194N for tax deduction …

Read moreHIGHLIGHTS OF UNION BUDGET 2021-22

UNION BUDGET 2021-22 PRESS INFORMATION BUREAU GOVERNMENT OF INDIA ****** KEY HIGHLIGHTS OF UNION …

Read moreHow to E-Verify Your Income Tax Return

After having successfully filed your income tax return , the next step is to verify it. The In…

Read morePopular Posts

Budget 2023 Highlights

Categories

- AADHAR 3

- Amendments 8

- Audit 2

- Budget 3

- Budget 2019 2

- Business &Profession 2

- CA EXAM 5

- CA Final Results 1

- CA Foundation Results 1

- CA Intermediate Results 1

- CA Results 1

- CASH WITHDRAWAL 1

- CBDT 7

- CBIC 9

- Chartered Accountants 2

- Clarifications 2

- Company Act 2013 2

- Copyright 1

- Digital Signature 1

- DSC 1

- Due Dates 7

- E Filing 6

- Earn Money 1

- EPF 3

- EPF in India 3

- ESI 2

- EVC 2

- Eway Bill 7

- GAAR 1

- GST Audit 2

- GST Filling 17

- GST in India 43

- GST Invoicing 4

- GST Late Fees 1

- GST News 27

- GST Practitioner 4

- gst rates 1

- GST Refund 3

- GST Registration 2

- GST Return 16

- GST Return Date Extension 5

- GST Revocation 2

- GST RULES 3

- GSTN 1

- GSTR 9 1

- Guidelines 2

- House Property 1

- ICAI 10

- IEC 1

- Income Tax 24

- INPUT IN GST 1

- Insolvency and Bankruptcy Board 3

- Insolvency Professional 2

- Invoice 1

- ITR 12

- ITR Filling 11

- ITR FORMS 3

- ITR Last Date 2

- LLP REGISTRATION 1

- MCA 7

- MCA Circular 3

- MSME 1

- NFRA 1

- Notification 15

- Notifications 2

- PAN Card 5

- Patents. 1

- PF 1

- Provident Fund 1

- RCM in GST 4

- Slab Rate 1

- startupindia 1

- TAN-PAN 1

- TCS in GST 2

- TDS 5

- TDS in GST 3

- TDS RETURN 1

- TDS/ TCS Return 1

- Trademark 1

- UDIN 1

- UIDAI 2

- Updates 28

![TDS on cash withdrawal in excess of Rs 1 crore [Section 194N]](https://blogger.googleusercontent.com/img/a/AVvXsEiY-UH1lErYhVl79fjgwByJIDJW4GgVFbfeDLvlvAcBnH7Qsi1bpjNIHei3L1Wq5sqafj_fMT0BpXjkoVMX5r-JvAeDv_2prxz3JjYdwZ0V28w8JALyXQH-bYdjCiMyIrmg7jckeSzS4F0W1LVw8jVtSbE3SA__MLLdnKsEF2At1Ma0o6PXMS2fLfgF=w680)