The most favorite word for an assessee under dictionary of GST is REFUND, and the most favorite word for Chartered Accountant(s) under the same dictionary is AUDIT (of course after REFUND...!). Till date, whichever forms and formats are prescribed for Returns, it clearly emphasizes on self assessment processes, yet for effective compliance with the various GST provisions and to ensure transparent and fair performance, audit provisions have been incorporated under GST Act(s) and rules there under.

What is Audit under GST?

The meaning of audit is given under section 2(13) of Central Goods and Services Tax Act, 2017.

“Audit” means the examination of records, returns and other documents maintained or furnished by the registered person under the GST Acts or the rules made there under or under any other law for the time being in force to verify the correctness of turnover declared, taxes paid, refund claimed and input tax credit availed, and to assess his compliance with the provisions of the GST Acts or the rules made there under.

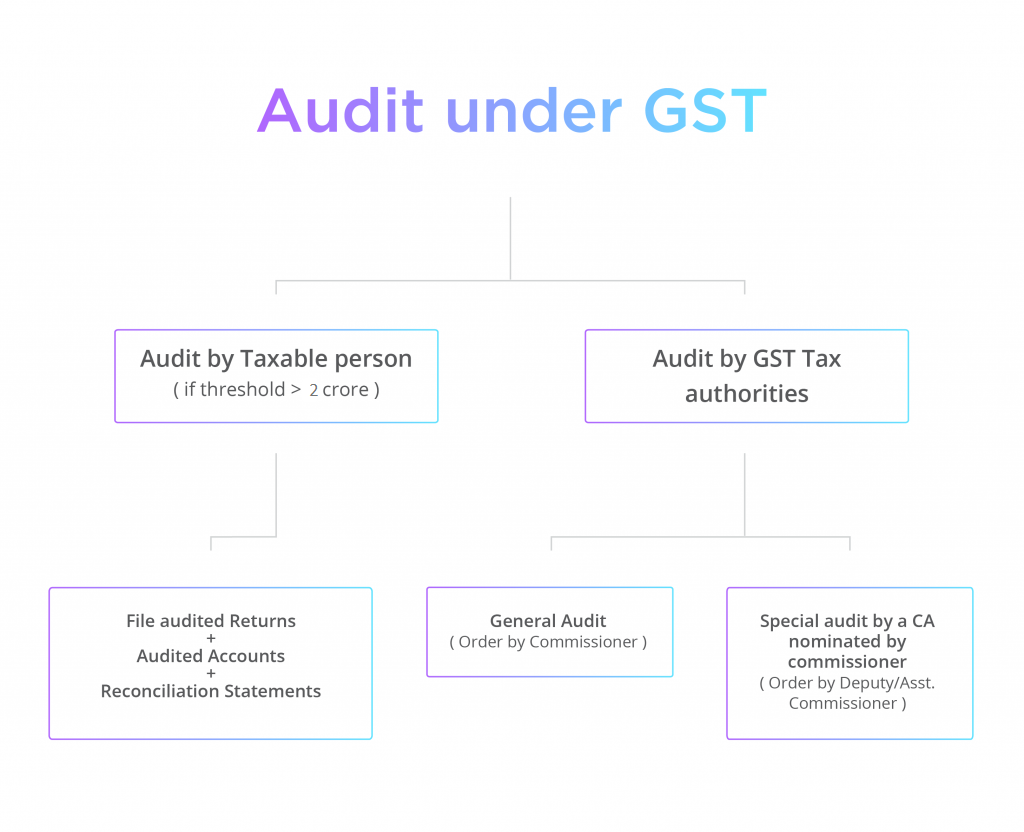

There are three types of audit as prescribed under GST.

1. 1st type of audit is to be done by a chartered accountant or a cost accountant; and it is mandatory if Turnover exceeds Rs. 2 Crore

2. 2nd type of audit is to be done by the commissioner or any officer authorised by him in terms of Section 65 and 66 of the CGST Act, 2017 read with Section 20 of the IGST Act, 2017

3. 3rd type of audit is called the Special Audit and is to be conducted under the mandate of Section 66 of CGST Act, 2017 read with Rule 102 of CGST Rules, 2017.

Let’s discuss first type of Audit – To be done by Chartered Accountant or a Cost Accountant in this Article.

To whom it is applicable?

Every registered person whose turnover during a financial year exceeds the prescribed limit of Rs. 2 Crore shall get his accounts audited by a Chartered Accountant or a Cost Accountant.

Now, question here arises is what is meant by Turnover?? Turnover here means aggregate Turnover as defined under Section 2(6) of the CGST Act/SGST Act:

Aggregate Turnover is defined as under.

“Aggregate Turnover” means the aggregate value of all taxable supplies (excluding the value of inward supplies on which tax is payable by a person on reverse charge basis), exempt supplies, exports of goods or services or both and inter-State supplies of persons having the same Permanent Account Number, to be computed on all India basis but excludes central tax, State tax, Union territory tax, integrated tax and cess.

Above definition is an exhaustive definition because the expression “means” [and not include] has been used. If we analyze the above definition word by word it would be easy to understand for us.

- The term “Taxable Supply” means a supply of goods or services or both which is leviable to tax under the GST Acts.

- By definition, exempt supply under GST is a broad term which includes nil rate supplies, non-taxable supplies and specific supplies which are notified as exempt from tax. The term “Exempt Supply” means supply of any goods or services or both which attracts nil rate of tax or which may be wholly exempt from tax under Section 11 of the CGST Act/SGST Act or under section 6 of the Integrated Goods and Services Tax Act. The term “exempt supply” includes non-taxable supply also. The term “Non-taxable Supply” means a supply of goods or services or both which is not leviable to tax under the CGST Act/SGST Act or under the IGST Act. Examples of non-taxable supply are Alcoholic Liquor for Human Consumption and five specified Petroleum Products i.e. Petroleum Crude, Motor Spirit (Petrol), High Speed Diesel [HSD], Natural Gas and Aviation Turbine Fuel [ATF] .

- Value of Export of Goods or Services or both;

- Supplies to branches in other States having same Permanent Account Number [PAN]

Exclusions while computing the Value of Aggregate Turnover:

- Value of Inward supplies on which tax is payable by a person on Reverse Charge basis.

- Central Tax, State Tax, Union territory Tax, Integrated Tax and Cess .

(1) Applicability of Turnover Limit for the period 01.07.2017 to 31.03.2018

GST has been implemented with effect from 01.07.2017. As a consequence, during the financial year 2017-18, GST remained in force only for a period of nine months from 01.07.2017 to 31.03.2018. Now, the question which arises here, is whether the above-mentioned annual turnover limit of Rs. 2 crore for audit purposes shall apply proportionately in the given case for a period of nine months or whether the foregoing limit shall apply as it is for a period of nine months ?. A suitable and immediate clarification from the Government(s) is required in this regard.

(2) Conduct of GST Audit State-Wise

It is worth emphasizing here that for audit purposes the turnover limit of Rs. 2 Crore shall be computed by including turnover in all the States or Union territories, as the case may be, i.e. on all India basis under same PAN. Furthermore, the foregoing threshold turnover limit of Rs. Two Crore is same for assessee in all the States and Union Territories. Thus, it can be safely inferred that no separate threshold limit has been specified for Special Category States. Since each of the State GST Acts also has the provisions relating to GST Audit, it appears that the GST audit shall be conducted state-wise. It also appears that only for the purpose of determining the eligibility of the assessee who is required to get its accounts audited by a Chartered Accountant or a Cost Accountant, the all India based turnover shall be considered. However, it shall be better if a suitable clarification from the Government(s) is issued in this regard at the earliest.

Statements and Documents to be submitted to the Proper Officer

It shall be necessary for the registered person to submit to the proper officer the following Statements and Documents:

a. A copy of the Audited Annual Accounts;

b. A Reconciliation Statement under Section 44(2) of the CGST Act/SGST Act i.e. a Statement reconciling the value of supplies declared in the Return furnished for the financial year with the audited Annual Financial Statements. Further, the aforesaid Reconciliation Statement shall be duly certified in FORM GSTR-9C, electronically through the common portal either directly or through a Facilitation Centre notified by the Commissioner.

c. Such other documents in such form and manner as may be prescribed, officially till date, there is no form prescribed yet. Though there are Form GSTR 9C & GSTR 9D are in circulation on social media since last one month. Form GST 9C is like Form 3CA of Income Tax Audit and Form GSTR –9D is akin to Form 3CD of Income Tax. Form GSTR-9D has 13 sections and 28 Annexure in which all details needs to be given by Taxpayers under GST Audit. In total it’s a 56 Page Audit Report Format.

Preparation for First GST Audit

GST had been implemented on 01.07.2017 and the first financial year in the GST Regime ended on 31.03.2018. Thus, it goes without saying that GST Audit shall be conducted for the first time. As a result, plenty of preparation is required both on the part of GST Auditor and GST Assessee. Besides, it is worth adding here that in case of Statutory Audit and Tax Audit (u/s 44AB of the Income Tax Act), the main thrust of the auditor is on the financial records. On the other hand, the scope of GST Audit is wider than scope of audit under Income Tax Act, 1961.Resultantly, it shall become obligatory on the part of the GST Auditor to have clear and precise understanding of various provisions of GST Acts/Rules made there under [including various mandatory records to be maintained] requirements of reporting and source of information, understanding the nature of business of the concerned assessee.

Following are the various steps which a GST Auditor may take in connection with the forthcoming first GST Audit in the year 2018:

1. GST Audit shall be new to everyone. Resultantly, a number of auditees who are required to be get their accounts audited may not have sufficient knowledge about the various applicable provisions of the GST Act(s)/Rules. Therefore, it becomes essential on the part of a Chartered Accountant or a Cost Accountant to inform the concerned auditees not only about the requirement of GST audit but also about the mandatory documents and other preparations to be done by them. 2. Confirm his eligibility to be the GST Auditor in accordance with provisions of Section 2(23) [which has defined the term “Chartered Accountant”] or Section 2(35) [which has defined the term “Cost Accountant”].

3. Understand the requirements of records to be maintained and advise the client to maintain the accounts and records so required.

4. Prepare the detailed Audit Programme as well as List of Records to be verified.

5. Prepare a detailed questionnaire to understand the operations/activities of the auditees.

6. Special attention must be paid to transactions not appearing in the Financial Accounts, but having GST implications.

7. Prepare various Reconciliation Statements

Appointing Authority of GST Auditor and Communication with Previous Auditor

In case of a company the appointment of the GST auditor shall be made by a resolution of the Board of Directors or by an officer of the company, if so authorized by the Board in this behalf. In case of a partnership firm or proprietary concern, the appointment can be made by a partner or the proprietor or a person authorized by the assessee. The acceptance of appointment by the proposed GST Auditor shall also be communicated in writing to the assessee.

Since the GST Audit is applicable for the first time for the financial year 2017-18, requirement of communication with the previous GST Auditor shall not arise. However, it is quite possible that in the pre- GST Regime, some assessees may be subject to VAT Audit, which was undertaken by an eligible auditor. However, GST Audit of the same assessee for the year 2017-18 may be allotted to a different Auditor. Now, the question arises is whether the new GST Auditor is required to communicate with the VAT Auditor. It is opined that since GST Acts are separate and independent Acts and the Audit specified therein is different VAT audit, there is no need for the GST Auditor to communicate with earlier VAT Auditor, before taking up the GST audit. However, in the subsequent years, in case of change in the GST Auditor, the new auditor shall communicate with the previous auditor as per the provisions of the Chartered Accountants Act, 1949 or Cost and Works Accountants Act, 1959.

General Checklist for a Chartered Accountant before Accepting the Appointment as an GST Auditor

1. Any member in part-time practice is not entitled to perform attest function. Only partners can perform attestation function.

2. In case of Joint Audits, all the auditors will have to sign the audit report. If the auditors have different opinion, then they should issue separate audit reports.

3. A chartered accountant having substantial interest in the assessee’s business cannot take up the audit.

4. A chartered accountant who is responsible for writing or the maintenance of books of account of an assessee is not eligible for being appointed an auditor of the same assessee. 5. Internal auditor of an assessee cannot be appointed as his tax auditor.

6. A chartered accountant is not eligible to accept the GST Audit of a person to whom he is indebted for more than Rs. 10,000/-.

7. A chartered accountant cannot charge professional fees based on a percentage of profit or which are contingent upon the finding or the result of the professional employment.

8. In many cases, an assessee may be having his GST registrations in many States. The assessee may appoint single auditor for all his registered establishments. Accounts and records might have been kept in the local language of the State. It is suggested that in the normal course, the auditor should not accept the audit of accounts written in a language which he/his staff does not understand.

As per Revised Minimum Recommendation Scale of Fees for the Professional assignment done by the Chartered Accountants, Committee for Capacity building of Members in Practice, has recommended feesof Rs.40000/- for Audit under GST for Class- A cities and Rs.20000/- for Class- B Cities.

Happy GST Audit season ahead with above mentioned minimum recommended fees !!

What is Audit under GST?

The meaning of audit is given under section 2(13) of Central Goods and Services Tax Act, 2017.

“Audit” means the examination of records, returns and other documents maintained or furnished by the registered person under the GST Acts or the rules made there under or under any other law for the time being in force to verify the correctness of turnover declared, taxes paid, refund claimed and input tax credit availed, and to assess his compliance with the provisions of the GST Acts or the rules made there under.

There are three types of audit as prescribed under GST.

1. 1st type of audit is to be done by a chartered accountant or a cost accountant; and it is mandatory if Turnover exceeds Rs. 2 Crore

2. 2nd type of audit is to be done by the commissioner or any officer authorised by him in terms of Section 65 and 66 of the CGST Act, 2017 read with Section 20 of the IGST Act, 2017

3. 3rd type of audit is called the Special Audit and is to be conducted under the mandate of Section 66 of CGST Act, 2017 read with Rule 102 of CGST Rules, 2017.

Let’s discuss first type of Audit – To be done by Chartered Accountant or a Cost Accountant in this Article.

To whom it is applicable?

Every registered person whose turnover during a financial year exceeds the prescribed limit of Rs. 2 Crore shall get his accounts audited by a Chartered Accountant or a Cost Accountant.

Now, question here arises is what is meant by Turnover?? Turnover here means aggregate Turnover as defined under Section 2(6) of the CGST Act/SGST Act:

Aggregate Turnover is defined as under.

“Aggregate Turnover” means the aggregate value of all taxable supplies (excluding the value of inward supplies on which tax is payable by a person on reverse charge basis), exempt supplies, exports of goods or services or both and inter-State supplies of persons having the same Permanent Account Number, to be computed on all India basis but excludes central tax, State tax, Union territory tax, integrated tax and cess.

Above definition is an exhaustive definition because the expression “means” [and not include] has been used. If we analyze the above definition word by word it would be easy to understand for us.

- The term “Taxable Supply” means a supply of goods or services or both which is leviable to tax under the GST Acts.

- By definition, exempt supply under GST is a broad term which includes nil rate supplies, non-taxable supplies and specific supplies which are notified as exempt from tax. The term “Exempt Supply” means supply of any goods or services or both which attracts nil rate of tax or which may be wholly exempt from tax under Section 11 of the CGST Act/SGST Act or under section 6 of the Integrated Goods and Services Tax Act. The term “exempt supply” includes non-taxable supply also. The term “Non-taxable Supply” means a supply of goods or services or both which is not leviable to tax under the CGST Act/SGST Act or under the IGST Act. Examples of non-taxable supply are Alcoholic Liquor for Human Consumption and five specified Petroleum Products i.e. Petroleum Crude, Motor Spirit (Petrol), High Speed Diesel [HSD], Natural Gas and Aviation Turbine Fuel [ATF] .

- Value of Export of Goods or Services or both;

- Supplies to branches in other States having same Permanent Account Number [PAN]

Exclusions while computing the Value of Aggregate Turnover:

- Value of Inward supplies on which tax is payable by a person on Reverse Charge basis.

- Central Tax, State Tax, Union territory Tax, Integrated Tax and Cess .

(1) Applicability of Turnover Limit for the period 01.07.2017 to 31.03.2018

GST has been implemented with effect from 01.07.2017. As a consequence, during the financial year 2017-18, GST remained in force only for a period of nine months from 01.07.2017 to 31.03.2018. Now, the question which arises here, is whether the above-mentioned annual turnover limit of Rs. 2 crore for audit purposes shall apply proportionately in the given case for a period of nine months or whether the foregoing limit shall apply as it is for a period of nine months ?. A suitable and immediate clarification from the Government(s) is required in this regard.

(2) Conduct of GST Audit State-Wise

It is worth emphasizing here that for audit purposes the turnover limit of Rs. 2 Crore shall be computed by including turnover in all the States or Union territories, as the case may be, i.e. on all India basis under same PAN. Furthermore, the foregoing threshold turnover limit of Rs. Two Crore is same for assessee in all the States and Union Territories. Thus, it can be safely inferred that no separate threshold limit has been specified for Special Category States. Since each of the State GST Acts also has the provisions relating to GST Audit, it appears that the GST audit shall be conducted state-wise. It also appears that only for the purpose of determining the eligibility of the assessee who is required to get its accounts audited by a Chartered Accountant or a Cost Accountant, the all India based turnover shall be considered. However, it shall be better if a suitable clarification from the Government(s) is issued in this regard at the earliest.

Statements and Documents to be submitted to the Proper Officer

It shall be necessary for the registered person to submit to the proper officer the following Statements and Documents:

a. A copy of the Audited Annual Accounts;

b. A Reconciliation Statement under Section 44(2) of the CGST Act/SGST Act i.e. a Statement reconciling the value of supplies declared in the Return furnished for the financial year with the audited Annual Financial Statements. Further, the aforesaid Reconciliation Statement shall be duly certified in FORM GSTR-9C, electronically through the common portal either directly or through a Facilitation Centre notified by the Commissioner.

c. Such other documents in such form and manner as may be prescribed, officially till date, there is no form prescribed yet. Though there are Form GSTR 9C & GSTR 9D are in circulation on social media since last one month. Form GST 9C is like Form 3CA of Income Tax Audit and Form GSTR –9D is akin to Form 3CD of Income Tax. Form GSTR-9D has 13 sections and 28 Annexure in which all details needs to be given by Taxpayers under GST Audit. In total it’s a 56 Page Audit Report Format.

Preparation for First GST Audit

GST had been implemented on 01.07.2017 and the first financial year in the GST Regime ended on 31.03.2018. Thus, it goes without saying that GST Audit shall be conducted for the first time. As a result, plenty of preparation is required both on the part of GST Auditor and GST Assessee. Besides, it is worth adding here that in case of Statutory Audit and Tax Audit (u/s 44AB of the Income Tax Act), the main thrust of the auditor is on the financial records. On the other hand, the scope of GST Audit is wider than scope of audit under Income Tax Act, 1961.Resultantly, it shall become obligatory on the part of the GST Auditor to have clear and precise understanding of various provisions of GST Acts/Rules made there under [including various mandatory records to be maintained] requirements of reporting and source of information, understanding the nature of business of the concerned assessee.

Following are the various steps which a GST Auditor may take in connection with the forthcoming first GST Audit in the year 2018:

1. GST Audit shall be new to everyone. Resultantly, a number of auditees who are required to be get their accounts audited may not have sufficient knowledge about the various applicable provisions of the GST Act(s)/Rules. Therefore, it becomes essential on the part of a Chartered Accountant or a Cost Accountant to inform the concerned auditees not only about the requirement of GST audit but also about the mandatory documents and other preparations to be done by them. 2. Confirm his eligibility to be the GST Auditor in accordance with provisions of Section 2(23) [which has defined the term “Chartered Accountant”] or Section 2(35) [which has defined the term “Cost Accountant”].

3. Understand the requirements of records to be maintained and advise the client to maintain the accounts and records so required.

4. Prepare the detailed Audit Programme as well as List of Records to be verified.

5. Prepare a detailed questionnaire to understand the operations/activities of the auditees.

6. Special attention must be paid to transactions not appearing in the Financial Accounts, but having GST implications.

7. Prepare various Reconciliation Statements

Appointing Authority of GST Auditor and Communication with Previous Auditor

In case of a company the appointment of the GST auditor shall be made by a resolution of the Board of Directors or by an officer of the company, if so authorized by the Board in this behalf. In case of a partnership firm or proprietary concern, the appointment can be made by a partner or the proprietor or a person authorized by the assessee. The acceptance of appointment by the proposed GST Auditor shall also be communicated in writing to the assessee.

Since the GST Audit is applicable for the first time for the financial year 2017-18, requirement of communication with the previous GST Auditor shall not arise. However, it is quite possible that in the pre- GST Regime, some assessees may be subject to VAT Audit, which was undertaken by an eligible auditor. However, GST Audit of the same assessee for the year 2017-18 may be allotted to a different Auditor. Now, the question arises is whether the new GST Auditor is required to communicate with the VAT Auditor. It is opined that since GST Acts are separate and independent Acts and the Audit specified therein is different VAT audit, there is no need for the GST Auditor to communicate with earlier VAT Auditor, before taking up the GST audit. However, in the subsequent years, in case of change in the GST Auditor, the new auditor shall communicate with the previous auditor as per the provisions of the Chartered Accountants Act, 1949 or Cost and Works Accountants Act, 1959.

General Checklist for a Chartered Accountant before Accepting the Appointment as an GST Auditor

1. Any member in part-time practice is not entitled to perform attest function. Only partners can perform attestation function.

2. In case of Joint Audits, all the auditors will have to sign the audit report. If the auditors have different opinion, then they should issue separate audit reports.

3. A chartered accountant having substantial interest in the assessee’s business cannot take up the audit.

4. A chartered accountant who is responsible for writing or the maintenance of books of account of an assessee is not eligible for being appointed an auditor of the same assessee. 5. Internal auditor of an assessee cannot be appointed as his tax auditor.

6. A chartered accountant is not eligible to accept the GST Audit of a person to whom he is indebted for more than Rs. 10,000/-.

7. A chartered accountant cannot charge professional fees based on a percentage of profit or which are contingent upon the finding or the result of the professional employment.

8. In many cases, an assessee may be having his GST registrations in many States. The assessee may appoint single auditor for all his registered establishments. Accounts and records might have been kept in the local language of the State. It is suggested that in the normal course, the auditor should not accept the audit of accounts written in a language which he/his staff does not understand.

As per Revised Minimum Recommendation Scale of Fees for the Professional assignment done by the Chartered Accountants, Committee for Capacity building of Members in Practice, has recommended feesof Rs.40000/- for Audit under GST for Class- A cities and Rs.20000/- for Class- B Cities.

Happy GST Audit season ahead with above mentioned minimum recommended fees !!

0 Comments