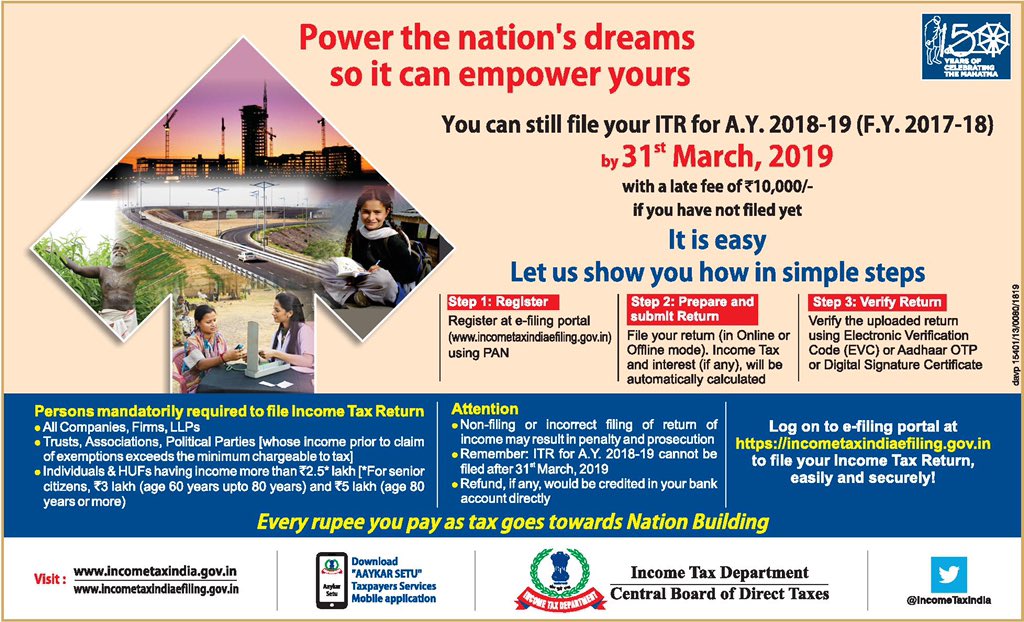

Did you know you can still file your ITR or income tax return for assessment year 2018-19?

The Income Tax Department has set a due date of March 31 for income tax assessees to file their income tax return for assessment year 2018-19 (AY2018-19) - which is financial year 2017-18 - with a late fee of Rss. 10,000, according to a Twitter by The Income Tax India. This means that individuals who have skipped filing their income tax return for the previous financial year can still do so by paying the late fee of Rs.s.10,000.

You can still file your Income Tax Return for A.Y. 2018-19 ( F.Y. 2017-18 ) by 31st March, 2019 with late fee if you have not filed yet. pic.twitter.com/G6juCzKA1z— Income Tax India (@IncomeTaxIndia) March 25, 2019

Non-filing of income tax return or filing an income tax return incorrectly may result in penalty and prosecution, the Income Tax Department added. It also said that the ITR for assessment year 2018-19 cannot be filed after March 31, the taxman noted - which means this is the last chance for assessees to clear their pending income tax returns for the financial year 2017-18. Any refund will be credited to such an income tax assessee's bank account directly, as per the normal process.

The Income Tax Department listed three steps for the concerned income tax assessees to file the late income tax return:

Step 1: Register on income tax e-filing website

The user is required to register himself/herself on the Income Tax Department's e-filing (online filing of income tax return) portal - incometaxindiaefiling.gov.in .

Step 2: Prepare and submit income tax return

Then, the user is required to file the income tax return either in online or offline mode.

Step 3: Verify income tax return

Once the income tax return is filed, the assessee is required to verify the same, noted the taxman. This can be done online by one of the three methods: through electronic verification (e-verification) code, through Aadhaar one-time passcode or through digital signature certificate.

0 Comments