When e-Way Bill is generated, a unique e-Way Bill Number (EBN) is made available to the supplier,

recipient and the transporter.

The e-Way Bill replaces the Way Bill, which was a physical document and existed during the VAT regime for the movement of goods.

ideally,e-Way Bill should be generated before the commencement of movement of goods above the value of INR 50,000 (either individual invoice or consolidated invoice of multiple consignments) and 100000/- in case of Delhi The movement of goods will be either about a supply/ reasons other than supply (like return)/ inward supply from an unregistered person.

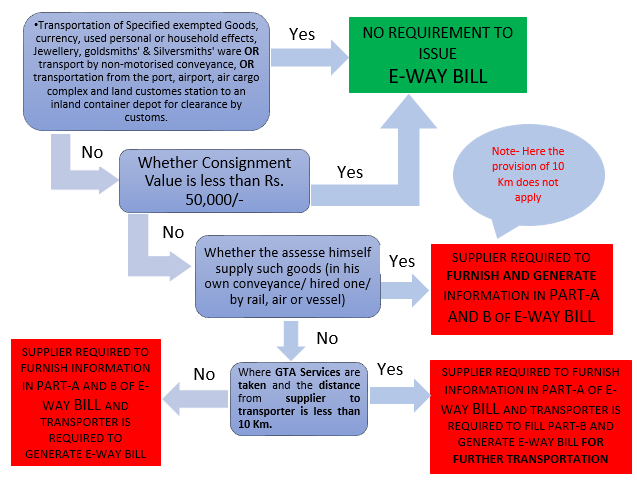

In Which cases, e-Way bill is not required?

The below are the cases when the generation of e-Way Bill is not a requirement:

- When the value of the consignment of goods moved is less than INR 50,000 (however, there are certain goods for which the e-way bill is mandatory even though the value of the goods is less than Rs. 50,000. Examples of such goods are when there is an inter-state movement of goods by the Principal to Job-worker and when the Inter-State Transport of Handicraft goods by a dealer is exempted from GST registration);

- When the conveyance used is a non-motor vehicle;

- When goods are transported from port/ airport/ air cargo complex/ land customs station to Inland Container Depot or Container Freight Station for customs clearance;

- Transport of certain goods.

- If within the same state, the goods are transported for a distance less than 10 km, from the business place of the transporter to the business place of the consignee;

- If within the same state, the goods are transported for a distance less than 10 km, from the business place of consignor to the business place of transporter for further transportation

0 Comments