The last date to file your ITR for the FY 2018-19 is 31 July 2019*. Not filing your ITR on time can lead to a penalty, but there are also other consequences and inconveniences attached to the delay. Let us understand these in detail below.

*for unaudited cases

To break this down; if you file post 31 July but before December of this year (i.e. 2019), a penalty of Rs 5000 will be levied. For returns filed after December 2019, penalty limit will be increased to Rs 10,000. However, as a relief to small taxpayers, the IT department has stated that if your total income is not more than Rs 5 lakh, the maximum penalty levied for delay will only be Rs 1000.

Earlier, taxpayers had a 2-year long window to revise and resubmit an erroneous ITR. This has now been decreased to one year from the end of the financial year. Therefore, the earlier you file, the longer would be the window available with you for revising your returns to rectify errors if any.

It’s important to note that one’s ITR cannot be filed if one hasn’t paid the taxes. The calculation of penalty will start from the date immediately after the due date i.e. 31 July (For current year i.e FY 2018-19, it was 31 July 2019). So, the longer you wait the more you will have to pay.

For Reference Click here

*for unaudited cases

1. Penalty for Late Filing u/s 234F

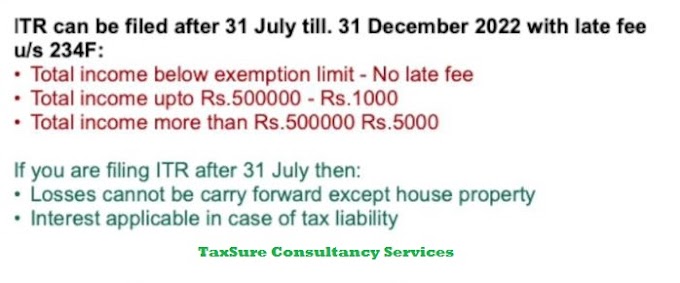

As per the changed rules notified under section 234F of the Income Tax Act which came into effect from 1 April 2017, filing your ITR post the deadline, can make you liable to pay a maximum penalty of Rs 10,000.| Late Filing Fee Details | ||

| E- Filing Date | Total income Below Rs 5,00,000 | Total income Above Rs 5,00,000 |

| 31st July 2019 | Rs 0 | Rs 0 |

| Between 1st Aug 2019 to 31st Dec 2019 | Rs 1,000 | Rs 5,000 |

| Between 1st Jan 2020 to 31st March 2020 | Rs 1,000 | Rs 10,000 |

Please Note :- IT Return for AY 2019-20 cannot be filled after 31st March, 2020 in any case.

2. Reduced Time for Revising Your Return

Let’s say you are filing your ITR and you end up making a mistake. Under the changed rules, you only have time till the end of relevant Assessment year to make the change (for ITRs from FY 2017-18).Earlier, taxpayers had a 2-year long window to revise and resubmit an erroneous ITR. This has now been decreased to one year from the end of the financial year. Therefore, the earlier you file, the longer would be the window available with you for revising your returns to rectify errors if any.

3. Payment of Interest

If you do not file income tax returns on or before the due date, you would be required to pay interest at the rate of 1% for every month, or part of a month, on the amount of tax remaining unpaid as per section 234A.4. Carry Forward of Losses is Not Permitted

If you have incurred any losses during the year say a loss under the head Capital Gains or any loss in your business, make sure you file your return within the due date. Not doing so will deprive you of carrying forward these losses to the next years for set off against income in future years.5. Delay in Receiving Refunds

In case you’re entitled to receiving a refund from the government for excess taxes you have paid, you must file your return before the due date to receive the refund at the earliest.For Reference Click here

0 Comments